In this article, we outline changes to GST laws that affect relevant property transactions. These laws took effect on 1 July 2018.

This guide is intended to provide buyers, sellers and real estate agents with a guide to their withholding obligations. We aren’t tax advisors, lawyers or accountants. Please seek the appropriate professional advice relevant to your personal circumstances.

Quick links

Form 2 – GST property settlement date confirmation

GST obligations for sellers

In brief

New laws that took effect on 1 July 2018 require buyers of new residential premises and new residential subdivisions to withhold a prescribed amount at settlement and remit this amount to the ATO. The amount remitted is then applied as a credit against the seller’s GST obligations in respect of the transaction. For the majority of contracts, the new GST laws will only apply to contracts entered into on or after 1 July 2018.

Background

Background to GST measure. Source: http://tv.ato.gov.au/ato-tv/media?v=bd1bdiunfuco49 3:00

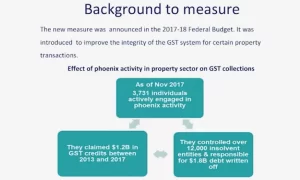

The new laws are designed to address phoenixing activity in the property sector.

Phoenixing is when a new company is created to continue the business of a company that has been deliberately liquidated to avoid paying debts, including taxes, creditors, and employee entitlements. This illegal activity robs the government of tax revenue and affects the whole community.

According to the ATO (4:01), “phoenixing in the property development industry has grown significantly in recent years. As of November 2017, the ATO had identified over 3,500 individuals who had actively been involved in this activity in the five years prior. These individuals controlled over 12,000 insolvent entities and were responsible for $1.8 billion in debt that had to be written off. But the same insolvent entities also claimed approximately $1.2 billion in input tax credits in the period between 2013 and 2017.”

Overview of the new measure

Overview of GST at settlement measure. Source: http://tv.ato.gov.au/ato-tv/media?v=bd1bdiunfuco49 10:29

Overview of GST at settlement measure. Source: http://tv.ato.gov.au/ato-tv/media?v=bd1bdiunfuco49 10:29

From 1 July 2018 purchasers of new residential premises or potential residential land (land that’s included in a property subdivision plan and does not contain any building that is in use for a commercial purpose) will pay part of the contract price directly to the ATO instead of to the supplier. This withholding mechanism changes the process for the collection of the GST. It doesn’t, though, change who is liable for the GST–the seller–but it does create new obligations for buyers, sellers and their respective representatives.

The new laws don’t make the transfer of land conditional on payment of the withholding amount but, in practice, settlement is unlikely to proceed until the seller is satisfied that the withholding amount will be paid to the ATO by the purchaser.

Current arrangements for payment of GST on relevant property transactions

Powerpoint slide: How GST currently applies to relevant property transactions

Prior to 30 June 2018 GST laws require the purchaser to pay the GST to the seller at settlement. The seller is then responsible for paying the GST to the ATO when they lodge their BAS. And this is where phoenixing occurs by the seller pocketing the GST collected from the buyer then liquidating their business prior to lodging their BAS.

The new measure stops this phoenixing activity by requiring the buyer to pay the GST directly to the ATO instead of paying it to the seller.

How GST is collected on relevant property transactions post-30 June 2018

Overview of GST at settlement measure. Source: http://tv.ato.gov.au/ato-tv/media?v=bd1bdiunfuco49 10:29

As of 1 July 2018, a seller of a new residential property or new residential subdivisions will be required to notify the buyer that they have a withholding obligation. Along with this notification, the seller is also required to provide the buyer with the information needed in order for the buyer to comply with their withholding obligations.

Once the buyer has received this information they’re required to submit to the ATO a GST Property settlement withholding notification (Form 1). This form serves to notify the ATO that a transaction is on foot, provide them with the details of the parties to the transaction and some additional information that allows the GST payment to be matched with the seller’s GST account.

On settlement, the buyer will be required to withhold the amount shown within the seller’s notification–the withholding amount. This amount is then forwarded to the ATO. At the same time the buyer is required to lodge (Form 2) – GST Property Settlement Date Confirmation which notifies the ATO that settlement has taken place. The amount remitted to the ATO becomes available as a credit to be applied against their GST payment liability.

How the new laws apply to terms contracts

Where a contract requires that the purchase price is paid in instalments then the withholding obligations arise when the first instalment of the purchase price that isn’t the deposit is paid.

For example, if a contract required the purchaser to pay a deposit then four instalments totalling the balance of the purchase price then the whole of the GST would be required to be withheld from the first instalment.

Scope of the new laws

Scope of withholding obligation. Source: http://tv.ato.gov.au/ato-tv/media?v=bd1bdiunfuco49

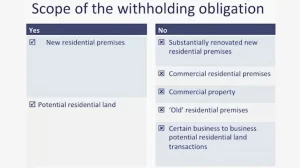

The new laws require buyers to withhold GST in respect of contracts for the purchase of new residential premises and potential residential land. They do not apply to properties that have been created by substantial renovations, commercial residential premises (includes hotels, motels, and inns but not retirement villages), ‘old’ residential properties (established or residential properties that have been sold previously) or commercial properties. Some business-to-business transactions of potential residential land are also excluded.

How much must be withheld?

GST at settlement withholding amounts. Source: http://tv.ato.gov.au/ato-tv/media?v=bd1bdiunfuco49

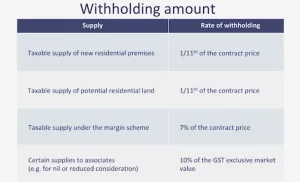

For the majority of cases where the withholding provisions apply, the buyer will be required to withhold one-eleventh of the contract price (the amount shown as the purchase price but excluding adjustments made at settlement).

Where the purchase price includes non-monetary consideration the value of that part of the consideration must also be included

Where the contract specifies that the margin scheme is to apply, then the buyer must withhold 7% of the contract price.

Where the contract creates a taxable supply to an associate then the withholding rate is 10% of the contract price or the GST-exclusive market value of the property, whichever is the greater.

Obligations for sellers

As of 1 July 2018, all sellers of residential premises (both new and existing) and potential residential land must notify the buyer, in writing, whether the buyer will be required to withhold an amount in respect of the GST applicable to the contract price. The notification from the seller can form part of the contract documentation or provide it to the buyer separately.

If no GST is payable then the seller need only notify the buyer that there is no requirement to withhold.

A notification is not required where the contract is for the sale and purchase of commercial residential premises, or potential residential land acquired for a creditable purpose by a GST registered entity.

What must be included in the seller notification?

There are a number of items that are to be included in the notification to the buyer by the seller. These include:

- Whether the buyer needs to withhold an amount from the purchase price and pay this to the ATO

- If they do need to withhold then;

- ABN supplier details

- Amount to be withheld and paid

- The date on which to make the payment to the ATO

- Market value where there’s non-monetary consideration

- Any other matters specified in the regulations e.g. GST grouping details.

Obligations for buyers

The buyer has a number of key obligations in respect of the new GST rules that must be completed. These include:

- If they are required to withhold and pay, prior to settlement, lodge Form 1 (GST property settlement withholding notification) using the information provided in the seller notification;

- Obtain a lodgement reference number (LRN) and payment reference number (PRN). This is obtained from the confirmation screen after submitting Form 1;

- On settlement, withhold the amount required in the seller notification;

- Pay the amount withheld to the ATO on the date specified in the notification, usually settlement date; and

- Lodge Form 2 (GST property settlement date confirmation) using the LRN and PRN obtained from Form 1.

If the sale doesn’t proceed for whatever reason the buyer has no obligation to lodge Form 2 or withhold and pay.

Buyers are not required to register for GST in order to comply with the new GST rules.

The buyer is not relieved of their requirement to withhold if the seller fails to provide the required notice.

Both Form 1 and Form 2 were to be integrated into the PEXA platform from around July 2018.

How is payment made?

There are three payment options available to the buyer (or their representative). These are:

- E-conveyancing – payment can be made via PEXA with the PRN entered prior to the amount being sent.

- EFT. This option is a bit tricky because the payment needs to match the LRN and PRN.

- Bank cheque in favour of the Commissioner of Taxation. When this option is chosen ensure the bank cheque is accompanied by a payment slip that includes the PRN and LRN. This will ensure the funds are recorded as a discharge of the buyer’s withholding obligations and are applied as a credit against the seller’s GST obligations.

If paying by bank cheque it’s possible to give this cheque to the seller for them to send to the ATO as the agent of the buyer. The seller must use the LRN and PRN provided by the buyer. The buyer’s obligations under the withholding laws aren’t discharged until the ATO receives the cheque.

The ATO is working on having a payment option through Australia Post.

Penalties

Where an individual seller fails to give the required notice to a buyer the ATO can impose a strict liability (criminal) penalty to a maximum of $21, 000. If the seller is a company that fine can be increased fivefold by the Court.

Where a buyer fails to pay the amount withheld may be required to pay a penalty equal to the amount that was required to be withheld and paid.

In summary

-

- It starts 1 July 2018 with some transitional provisions for off the plan sales.

- Seller provides a notification to the buyer of withholding obligations. Notification must include:

- Name and ABN of supplier

- Amount to pay to ATO

- When the purchaser is required to pay

- GST payable based on the non-market value of consideration e.g. business-to-business

- Any other matters (not sure what that means)

- Notification must be in writing and can be included in the contract.

- If supply is taxable but no notification is provided buyer must withhold.

- Purchaser lodges Form1 obtains LRN (lodgement reference number) and PRN (payment reference number). To be done ASAP after the contract date.

- Purchaser withholds amount and pays to ATO on settlement, submits Form2 including LRN and PRN provided earlier.

- Seller lodges BAS and uses GST paid as a credit

- GST calculated on the full purchase price.

- Instalment contracts GST withheld from the first instalment of the purchase price.

- Withholding not required for:

- Substantially renovated residential

- Commercial residential

- ‘Old’ residential

- Some business-to-business

- Pay either 1/11th of the purchase price, 7% of the purchase price if on margin scheme or 10% of ex-GST market value where non-monetary consideration is involved.

- No requirement for buyers to register for GST

- TFNs not required on either form although providing them will assist ATO.

- No need to withdraw Form1 if the sale doesn’t proceed.

- No need to lodge Form2 if the sale doesn’t proceed.

- If the amount is withheld in error seller can request a refund post-settlement subject to time limitations on request.

- Payment options include:

- EFT

- Bank cheque

- PEXA (includes LRN and PRN. Future versions of PEXA to include integration of Form1 and Form2)

- The penalty for the buyer is the amount of GST that should have been withheld. For sellers, up to $21,000 could be five times that amount.

Featured image credit: Travellers travel photobook on Flickr